Looking to streamline your financial processes and reduce your back-office costs? Modern finance demands more than just processing transactions—it requires strategic insight and operational excellence. IQ BackOffice’s comprehensive finance process optimization solutions combine proven technology with expertise to revolutionize your finance and accounting operations.

Introduction The financial landscape has fundamentally transformed. In an era defined by economic volatility, regulatory scrutiny, and accelerating digital innovation, CFOs stand at the helm of organizations navigating increasingly complex…

By embracing AI as a strategic tool and fostering a collaborative environment, accounting outsourcing firms can empower businesses to achieve long-term financial success and navigate the complexities of modern finance with greater confidence.

Artificial intelligence concept

When making this critical decision, it's essential to understand that accounting goes beyond just balancing books—it's about steering the business toward long-term growth and financial success.

The future of accounting outsourcing is poised for creativity and growth. It's not just about adapting; it's about thriving in a time of potential.

Outsourced Accounting services present a transformative approach not just to your department’s efficiency but your business as a whole.

By embracing technology and aligning it with strategic outsourcing partnerships, businesses have a competitive advantage in their operations.

Outsourcing your accounting processes can streamline workflows and address other challenges easily managed by modifying existing systems.

As the business landscape continues to evolve and face new challenges, outsourcing accounting functions, among other solutions, may be a key pillar in achieving long-term success.

Outsourcing has become a popular strategy for businesses looking to improve efficiency, and the accounting department is no exception.

With the steady reinvigoration of the economy, outsourcing accounting services is growing and proving to be a popular business solution.

While outsourced accounting can be an effective solution for many companies, we look at the many misconceptions surrounding this practice.

Ken Johnson, IQ BackOffice, discusses mistakes he sees accounting departments make when outsourcing accounting functions to execute their strategic plan.

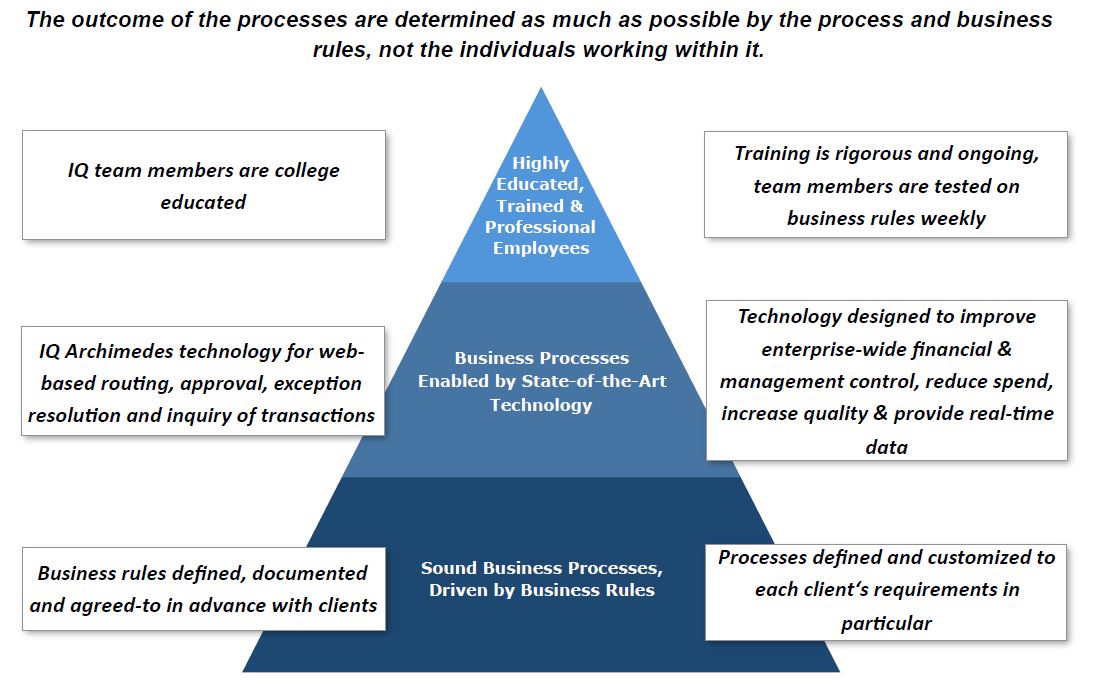

Companies turn to outsourcing for better technology, business processes, and lower costs to improve outcomes and maximize profits while minimizing risks.

Outsourcing accounting is generally worthwhile especially for businesses whose core-competencies fall outside of the financial and accounting disciplines.

Because accounting duties include many low-value transaction-laden activities, outsourcing and automation are viable alternatives to keeping them in-house.

Outsourced accounting costs are generally lower than the cost of having the accounting function operate in-house, generally between 30-75% of current costs.

Outsourcing accounting processes, for example, generally saves between 30% and 75% of current costs, while improving quality and timeliness.

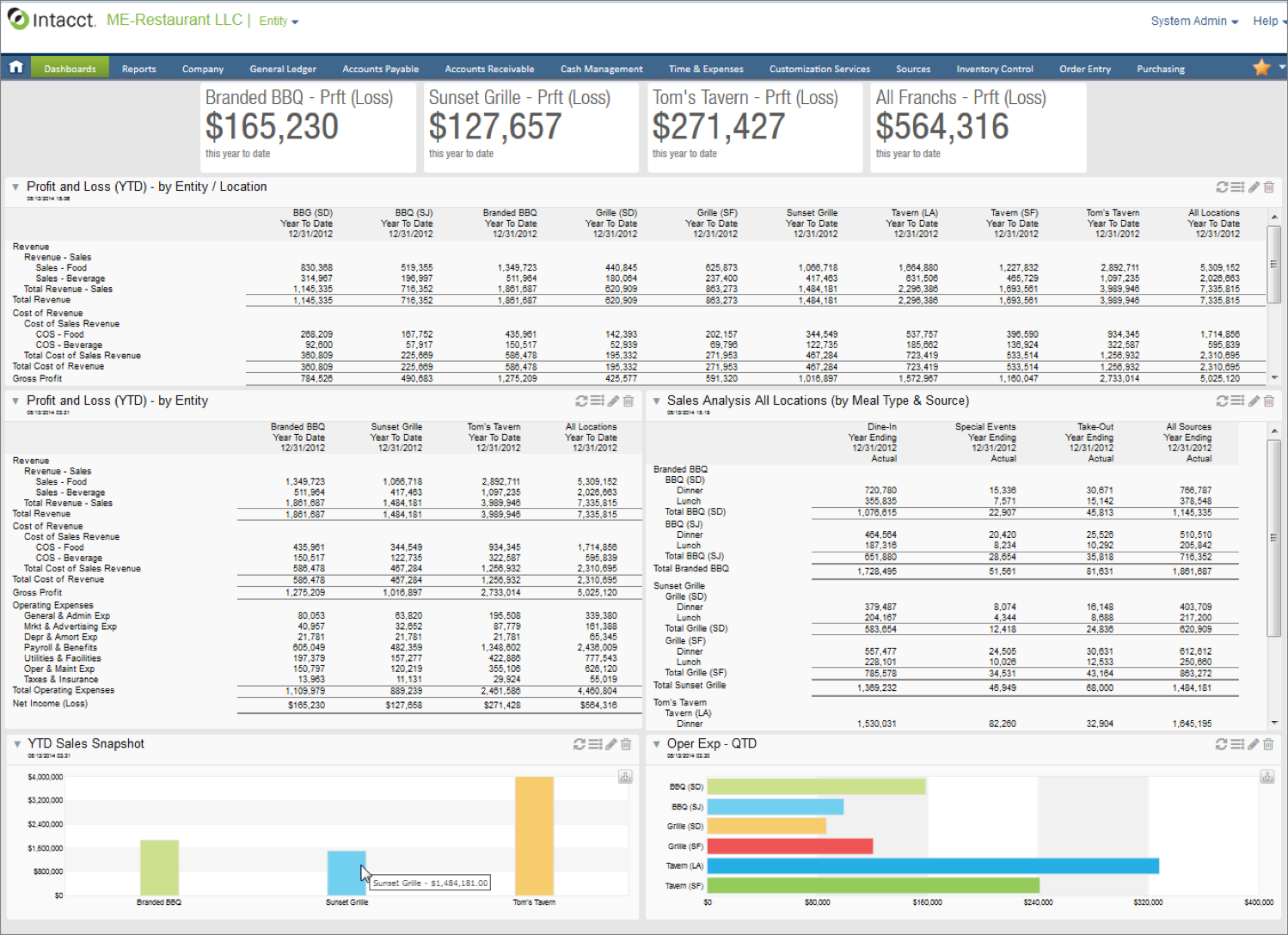

Imagine your accounting processes reengineered into a customized solution that offers 99.97% quality, 40-50% cost reduction, close on financials to 3 days.

According to Debi Warren, CPA, CGMA, “adding bookkeeping and accounting resources can increase firm revenue and provide your clients with more options.” Accounting outsourcing, she writes, enables firms to offer a greater variety, and level, of expertise at a lower cost.

How can an organization solve Accounting Transaction Processing problems while assuring the highest level of efficiency and cost savings? Outsourcing!